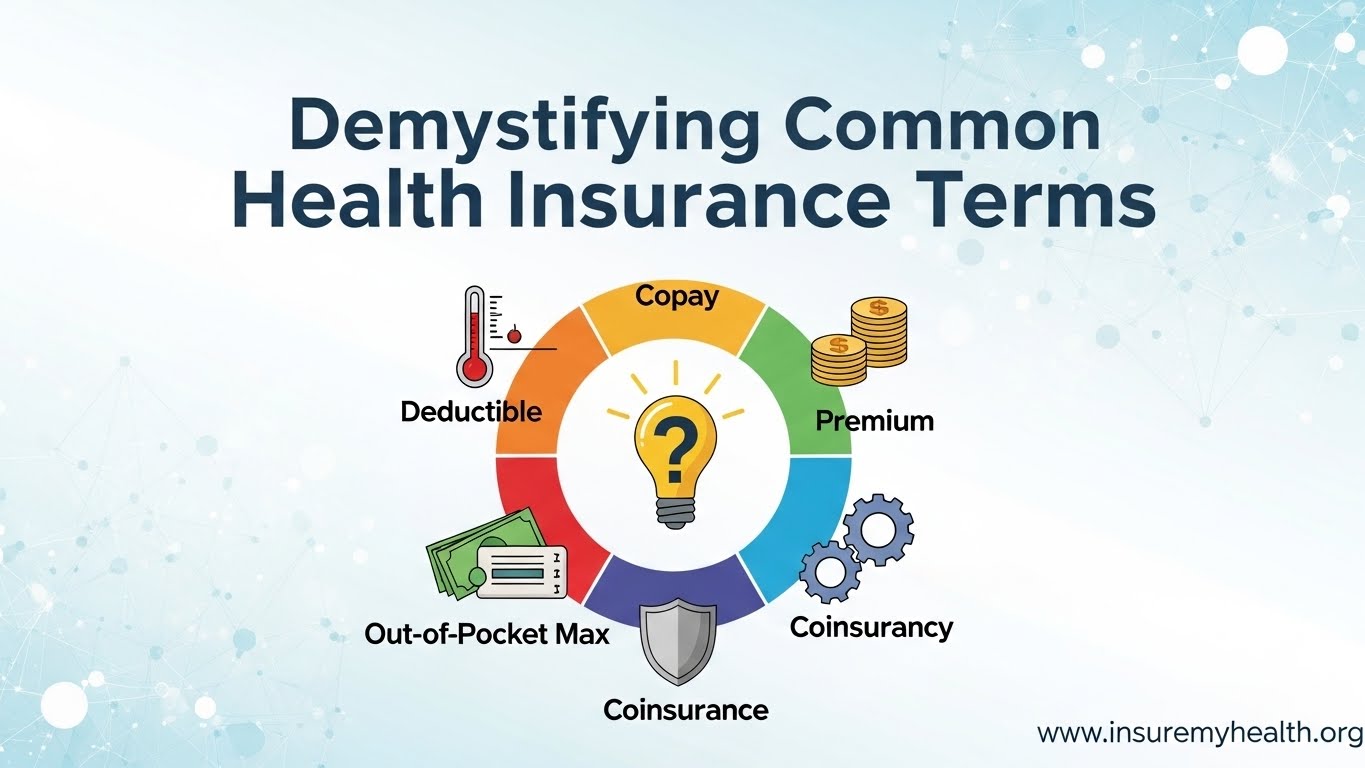

Navigating the world of health insurance can be overwhelming, especially with the plethora of terminology that can often feel like a foreign language. Understanding common health insurance terms is essential for making informed decisions about your coverage. This article aims to demystify key health insurance terms, helping you to better understand your policy and make the most of your healthcare benefits.

1. Premium

Definition: The premium is the amount you pay for your health insurance coverage, typically billed monthly.

Importance:

- Budgeting: Knowing your premium helps you budget for your healthcare expenses.

- Plan Selection: Different plans come with varying premiums, which can influence your choice based on your financial situation.

2. Deductible

Definition: A deductible is the amount you must pay out-of-pocket for healthcare services before your insurance begins to pay.

Importance:

- Cost Management: Understanding your deductible can help you anticipate your healthcare costs.

- Plan Comparison: Plans with lower premiums often have higher deductibles, so it’s crucial to weigh these factors when selecting a plan.

3. Copayment (Co-Pay)

Definition: A copayment is a fixed amount you pay for a specific healthcare service at the time of the visit, such as a doctor’s appointment or prescription.

Importance:

- Predictable Costs: Copayments provide predictable costs for routine services, making budgeting easier.

- Incentive for Care: Lower copayments can encourage you to seek necessary medical care.

ALSO READ>> Why Health Insurance is Essential for Everyone

4. Coinsurance

Definition: Coinsurance is the percentage of costs you pay for a covered healthcare service after you’ve met your deductible.

Importance:

- Cost Sharing: Coinsurance represents your share of the costs, which can vary significantly between plans.

- Financial Planning: Knowing your coinsurance percentage helps you estimate your out-of-pocket expenses for various services.

5. Out-of-Pocket Maximum

Definition: The out-of-pocket maximum is the highest amount you will pay for covered healthcare services in a plan year. Once you reach this limit, your insurance covers 100% of your healthcare costs.

Importance:

- Financial Protection: This limit protects you from excessive medical expenses.

- Plan Evaluation: Comparing out-of-pocket maximums can help you choose a plan that offers the best financial protection.

6. Network

Definition: A network is a group of healthcare providers and facilities that have contracted with an insurance company to provide services at reduced rates.

Importance:

- Cost Efficiency: Using in-network providers typically results in lower costs.

- Access to Care: Understanding your plan’s network can help you find available providers and facilities.

RELATED POST>> Health Insurance Options for Families: What You Need to Know

Understanding Health Insurance: A Complete Beginner’s Guide for 2024

10 Natural Ways to Boost Your Immune System for Better Health

7. Pre-Existing Condition

Definition: A pre-existing condition is a health issue that existed before the start of your health insurance coverage.

Importance:

- Coverage Implications: Some plans may have waiting periods or exclusions for pre-existing conditions, affecting your access to care.

- Legal Protections: The Affordable Care Act prohibits insurers from denying coverage based on pre-existing conditions, ensuring access to necessary care.

8. Essential Health Benefits

Definition: Essential health benefits are a set of healthcare service categories that must be covered by certain health plans under the Affordable Care Act.

Importance:

- Comprehensive Coverage: Knowing what constitutes essential health benefits ensures you receive necessary services without unexpected costs.

- Plan Comparison: Understanding these benefits helps you compare plans effectively.

9. Health Savings Account (HSA)

Definition: An HSA is a tax-advantaged savings account that allows you to set aside money for qualified medical expenses.

Importance:

- Tax Benefits: Contributions to an HSA are tax-deductible, and withdrawals for qualified expenses are tax-free.

- Long-Term Savings: HSAs can be a valuable tool for managing healthcare costs, especially for those with high-deductible health plans.

10. Flexible Spending Account (FSA)

Definition: An FSA is an employer-established benefit that allows employees to set aside pre-tax dollars for eligible healthcare expenses.

Importance:

- Tax Savings: Contributions to an FSA reduce your taxable income, providing immediate tax benefits.

- Use It or Lose It: Unlike HSAs, FSAs typically require you to use the funds within the plan year, so careful planning is essential.

11. Lifetime Limit

Definition: A lifetime limit is a cap on the total benefits an insurance company will pay for an individual’s covered services during their lifetime.

Importance:

- Financial Security: Understanding if your plan has a lifetime limit can help you assess your long-term healthcare needs.

- Legal Changes: The Affordable Care Act prohibits lifetime limits on essential health benefits, providing greater security for policyholders.

12. Preventive Services

Definition: Preventive services are healthcare services aimed at preventing illnesses or detecting them early, such as vaccinations, screenings, and annual check-ups.

Importance:

- Cost-Free Care: Many health plans cover preventive services at no cost to the patient, encouraging proactive health management.

- Long-Term Health: Utilizing preventive services can lead to early detection of health issues, improving long-term health outcomes.

13. Claim

Definition: A claim is a request for payment that you or your healthcare provider submits to your insurance company for covered services.

Importance:

- Understanding the Process: Knowing how claims work can help you navigate your insurance benefits more effectively.

- Monitoring Expenses: Keeping track of claims can help you manage your healthcare costs and ensure you receive the benefits you’re entitled to.

14. Exclusions

Definition: Exclusions are specific conditions or circumstances that are not covered by your health insurance policy.

Importance:

- Policy Awareness: Understanding exclusions helps you avoid unexpected costs for services that your plan does not cover.

- Informed Decisions: Being aware of exclusions can guide your healthcare choices and help you select a plan that meets your needs.

15. Summary

Understanding common health insurance terms is vital for navigating your health insurance policy effectively. By familiarizing yourself with these key terms, you can make informed decisions about your healthcare, budget for medical expenses, and maximize your insurance benefits.

Conclusion

Health insurance can be complex, but understanding the terminology can empower you to make better choices regarding your coverage. Whether you are selecting a new plan, filing a claim, or seeking care, being knowledgeable about health insurance terms will help you navigate the system with confidence.

By mastering these common health insurance terms, you can demystify the complexities of your health coverage and ensure that you are making the most of your benefits. For more information on health insurance and related topics, visit www.insuremyhealth.org.